KIRAN KUMAR K V, Faculty-Finance

~~ Beginning of the Case ~~

Feel Secure Wealth Managers (FSWM) LLP, a private asset management firm head quartered in Mumbai, maintains a stock and bond portfolio and also invests in four quadrants of the real estate market: private equity, public equity, private debt andpublic debt. Each of the four real estate quadrants has a manager assigned to it. FSWM intends to increase its allocation to real estate. The Chief Investment Officer (CIO) Gayathri Sheelvanthas scheduled a meeting with the four real estate managers to discuss the allocation to real estate and to each real estate quadrant. Nithin Milind, who manages the private equity quadrant, believes his quadrant offers the greatest potential and has identified three investment properties to consider for acquisition. Selected information for the three properties is presented in Table-1 below:

Selected Information on Potential Private Equity Real Investments | |||

Property | |||

A | B | C | |

Property Description | Single Tenant Office | Shopping Centre | Warehouse |

Size (Sqmt) | 3000 | 5000 | 9000 |

Lease Type | Net | Percentage Gross | Gross |

Rental Income pa (at full occupancy) | Rs. 575000 | Rs. 610000 | Rs. 590000 |

Other Income | Rs. 27000 | Rs. 183000 | Rs. 29500 |

Vacancy and Collection Loss | Rs. 0 | Rs. 61000 | Rs. 59000 |

Property Management Fee | Rs. 21500 | Rs. 35000 | Rs. 22000 |

Other Operating expenses | Rs. 0 | Rs. 234000 | Rs. 0 |

Discount Rate | 11.5% | 9.25% | 11.25% |

Growth Rate | 2% | 0%* | 3% |

Terminal Cap Rate | 11% | ||

Market Value of Land | Rs. 1500000 | Rs. 1750000 | Rs. 4000000 |

Replacement Costs – Building Costs – Developer’s Profit | Rs. 8725000 Rs. 410000 | Rs. 4500000 Rs. 210000 | Rs. 12500000 Rs. 585000 |

Deterioration – Curable & Incurable | Rs. 4104000 | Rs. 1329000 | Rs. 8021000 |

Obsolescence – Functional – Locational – Economic | Rs. 250000 Rs. 500000 Rs. 500000 | Rs. 50000 Rs. 200000 Rs. 100000 | Rs. 750000 Rs. 1000000 Rs. 1000000 |

Comparable Adjusted Price per SQMT – Comparable property-1 – Comparable property-2 – Comparable property-3 | Rs. 1750 Rs. 1825 Rs. 1675 | Rs. 950 Rs. 1090 Rs. 875 | Rs. 730 Rs. 680 Rs. 725 |

* Assumptions behind above estimates: Assumption-1: The holding period for each property is expected to be five years. Assumption-2: Property B is expected to have the same net operating income for the holding period due to existing leases, and a one-time 20% increase in year-6 due to lease rollovers. No further growth is assumed thereafter. | |||

To prepare for the upcoming meeting, Nithin has asked his research analyst Shiju Sunny, for a valuation of each of these properties under the income, cost and sales comparison approaches using the above information and the two assumptions. In reviewing Table-1, Nithin notes the disproportionate estimated obsolescence charges for Property-C relative to the other properties and asks Shiju to verify the reasonableness of these estimates. Nithinalso reminds Shiju that they will need to conduct proper due diligence. In that regard, Nithin indicates that he is concerned whethe

r a covered parking lot that was added to Property-A encroaches (is partially located) on adjoining properties. Nithin would like for Shiju to identify an expert and present documentation to address her concerns regarding the parking lot.

r a covered parking lot that was added to Property-A encroaches (is partially located) on adjoining properties. Nithin would like for Shiju to identify an expert and present documentation to address her concerns regarding the parking lot.

Shiju summarily writes down the below tasks for preparing a report:

- Compare the four quadrants and suggest what arguments can Nithin put forth to demand higher allocation into his quadrant (i.e., private equity) of real estate investments.

- Rank the three properties in the order of highest to lowest owner exposure to risk related to operating expenses.

- Determine the value of the properties using Direct Capitalization Method

- Determine the value of the properties using Discounted Cash Flow Method

- Determine the value of the properties using Cost Approach

- Determine the value of the properties using Sales Comparison Approach

- Give an overview of due diligence process to be followed by Shiju for Property-A

~~ End of Case ~~

INSTRUCTOR REFERENCES:

I. What courses are intended to be using this case?

The case can be used as part of courses like Alternative Investments, Portfolio Management, Financial Modeling and Corporate Valuation.

I. What models/concepts/theories can be explained through this case?

The case can be used to demonstrate the below concepts/theories/models/applications:

a) Real Estate as Financial Asset – Types (Private Equity, Public equity, Private Debt & Public Debt)

b) Types of Real Estate Properties – Single-family, Multi-family, Office & Other Commercial Spaces

c) Types of leases – Gross Lease, Net Lease and Percentage Lease

d) Risks & rewards of investing in real estate

e) Valuation of real estate investments using the three approaches – Income, Cost & Sales Comparison

f) Process of Real Estate Due Diligence< o:p>

I. What main issue/problem is addressed in this case?

The prime focal point of this case is the challenges of accommodating heterogenic characteristics of different types of properties in the valuation process.

I. Teaching Notes / Solutions

This case can be best be solved with the use of MS-Excel. Student should be comfortable in entering the formulas, using functions in spreadsheet. Although, no major quantitative work is involved, basic financial mathematics knowledge is essential.

A total of 3 hours/sessions with demonstration would be required, including the case briefing. It would be ideal to group the students into groups of 3-4 members in each.

Outline solutions for solving key issues (Explained question-wise):

1. Compare the four quadrants and suggest what arguments can Nithin put forth to demand higher allocation into his quadrant (i.e., private equity) of real estate investments.

Use the table below to explain the basic forms of real estate investments:

Equity | Debt | Remarks | |

Private | Direct investments in Real Estate. T his can be through sole ownership, joint ventures, real estate limited partnerships, or other forms of commingled funds | Mortgages | Larger investments Requires property management expertise |

Public | Shares of real estate operating companies and shares of REITs | Mortgage-backed Securities (residential and commercial) | Liquid markets Possible diversification |

Remarks | Participate in Value Appreciation & Income Stream | Similar to bonds |

Arguments for Private Equity in Real Estate:

Private equity in real estate enable greater decision-making control relative to real estate investments in the other three quadrants. A private real estate equity investor or direct owner of real estate has responsibility for management of the real estate, including maintaining the properties, negotiating leases and collecting rents. These responsibilities increase the investor’s control in the decision-making process. Investors in publicly traded REITs or real estate debt instruments would not typically have significant influence over these decisions.

2. Rank the three properties in the order of highest to lowest owner exposure to risk related to operating expenses. Give a brief description

Types of Leases:

Gross Lease– Owner has to bear/pay the operating expenses

Net Lease– Tenant has to bear/pay the operating expenses

Percentage Lease – Tenants pay additional rent once their sales reach a certain level

Risk Categorization – Owner is exposed to higher risk, in case of Gross Lease when compared to Net Lease; Owner is also taking higher risk when he accepts Percentage Lease arrangement.

Ranking in the given case:

Highest risk – Property B àModerate risk – Property C àLowest risk – Property A

3. Determine the value of the properties using Direct Capitalization Method

T

hree Approaches to Real Estate Valuation

hree Approaches to Real Estate Valuation

1) Income Approach: Considers what an investor would pay based on expected rate of return that is commensurate with the risk of the investment. The value estimated with this approach is essentially the present value of the expected future income from the property, including proceeds from resale at the end of a typical investment holding period.

(a) Direct Capitalization Methodestimated the value of an income-producing property based on the level and quality of its net operating income

Capitalisation Rate = Discount rate – Growth rate

Value = Net Operating Income / Cap Rate

(b) Discounted Cash Flow Method is different from Direct Capitalisation Method by considering a series of cash flows and terminal cash flows getting discounted back to present

Value = PV of NOI for the foreseeable period + PV of terminal period value

2) Cost Approach: Considers what it would cost to buy the land and construct a new property on the site that has the same utility or functionality as the property being appraised. Adjustments are made if the subject property is older or not of a modern design, if it is not feasible to construct a new property in the current market, or if the location of the property in not ideal for the current use.

Value = Replacement Cost of Building – Curable & Incurable Obsolescence + Highest & Best Use Value of the Land

3) Sales Comparison Approach:Considers what similar properties transacted for in the current market. Adjustments are made to reflect differences between the properties, such as size, location, age and condition of the property and to adjust for differences in market conditions at the times of sale.

Value = (Comparable Transaction Value/No. of SQMT or SQFT of the Comp) X (No. of SQMT or SQFT of Subject Property)

Computation of Net Operating Income

NOI = Rental Income + Other Income – Vacancy & Collection Loss – Property Management Costs

Cap Rate = Discount Rate – Growth Rate

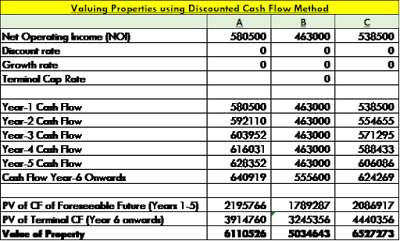

4. Determine the value of the properties using Discounted Cash Flow Method

5. Determine the value of the properties using Cost Approach

6. Determine the value of the properties using Sales Comparison Approach

7. Give an overview of due diligence process to be followed by Shiju for Property-A

Due diligence is conducted to verify other facts and conditions that might affect the value of the property and that might not have been identified by the appraiser. The following is an example of items that are usually part of this process

- Review the leases for the major tenants and review the history of rental payments and any defaults or late payments

- Look at cash flow statements of the previous owner for operating expenses and revenues

- Have an environmental inspection to be sure that there are no issues, such as a contaminant material on the site

- Have physical/engineering inspection to be sure that there are no structural issues with the property and to check the condition of the building systems, structures, foundation and adequacy of utilities

- Have an attorney or appropriate party review the ownership history to be sure that there are no issues related to the seller’s ability to transfer free and clear title that is not subject to any previously identified liens

- Review service and maintenance agreements to determine whether there are recurring problems

- Have a property survey to determine whether the physical improvements are in the boundary lines of the site and to find out if there are any easements that would affect the value

- Verify that the property is compliant with zoning, environmental regulations, parking ratios and so on

- Verify that property taxes, insurance, special assessments and so on have been paid

With regards to Property-A’s specific issue of potential encroachment of the parking lot, Shiju should ideally take up an independent property survey and determine whether the physical improvements, including the covered parking lot, are in the boundary lines of the site and if there are any easements that would affect the value of the property.

~~~~~~~~~~~~~~~

Author is a faculty in Finance @ International School of Management Excellence, Bangalore (www.isme.in)

feedback: kirankvk@isme.in