By: Joydeep Dass

Faculty – Finance

Email: Joydeep@isme.in

Mobile: +91-9175360870

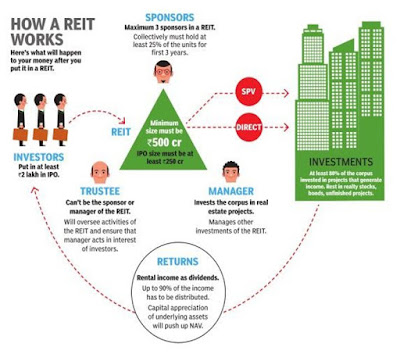

Introduction – REIT is the acronym for Real Estate Investment Trusts. REIT’s are similar to mutual funds where a group of investors pool resources to invest in income generating real estate properties. REITS are also called as “Real Estate Stock”. REIT’s are constituted as a corporate and they essentially manage a portfolio of real estate properties, which could be a mall, offices, hotels, residential units, warehouses, shopping or community centers. All REIT investments has to be in India directly or via SPV with 50% stake with the SPV holding 80% of REIT assets.

Legal Regulatory Framework – Recently, SEBI has approved the agreement of the Blackstone & Embassy group to operate a REIT. REIT’s will be required to be float an initial public offering (IPO), with the issue size capped at 250 crores, list in stock exchange, and the units held by it can be traded as securities in dematerialized form. Per SEBI guidelines, an investor can start with an initial investment of two lacs to secure a unit in REIT and in return would be entitled to good return on investment and handsome capital appreciation. The investor would also be able to diversify the portfolio in real estate sector. The investor will have to buy from either the primary or the secondary market. All REIT’s are mandatorily required to appoint Trustees to oversee the interest of the investors.

In order to be eligible to operate as a REIT, 90% of the income has to be distributed as dividends, 80% of the investments has to be in revenue generating properties, and 10% of the investments has to be in real estate construction. The minimum asset size of investment would be 500 crores. NRI’s and foreign portfolio Investors can also invest in REIT’s. All REITs should have a valuation on a yearly basis through a registered valuation professional. The Net Asset Value (NAV) to be reported within 15 days of valuation and any acquisition or transfer of REIT Assets are required to meet the prescribed SEBI valuation guidelines.

Types – REIT’s registered in India can be of three types.

1. Equity REIT’s – The property will be owned by REIT and the tenants will pay rent in return to REIT

2. Mortgage REIT’s – The property is not owned by REIT. REIT will simply create equitable mortgages in property in return of fixed EMI every month.

3. Hybrid REIT’s – REIT will invest in both equity & mortgage REIT’s

Taxation Aspects of REIT – All stakeholders in a REIT will be liable to pay tax. The Finance (No.2) Act, 2014 had amended the Income Tax Act to put in place a special taxation regime in respect of business trusts. The business trust as defined in of the IT Act includes a Real Estate investment Trust (REIT) or an Infrastructure Investment Trust (INVIT) which is registered under regulations framed by Securities and Exchange Board of India (SEBI).

Major players in a REIT:-

1. Unit Holders – The unit holders are the retail investors, and can be any person. Unit holders can be a foreign investor subject to RBI approval & Government of India. They will carry equal voting rights.

2. Sponsor – An entity responsible for setting up REIT. There should be at-least three sponsors and the collective net worth to be 100 crores and individual net worth to be 20 crores. Sponsors should have 5 years of experience in the real estate industry. Sponsors should have a proof of completed projects and their investment will have a lock in period of three years.

3. Trustee – A person registered with SEBI. He is responsible for holding assets in the name of REIT and must ensure that the assets have clear legal & marketable titles.

4. Manager – A person responsible for day-to-day operational management of REIT. The person should have at-least 5 years of experience in the real estate management & development.

5. Principal Valuer – A person should hold a valid license & be authorized to undertake valuation under the Companies Act, 2013. The person should be of impeccable integrity with 5 years of experience in real estate valuation.

Conclusion – The Government is keen to refine the real estate sector in India & plans are on the anvil to develop this sector very fast. A few months back the Government also passed the RERA (Real Estate Regulation Act_2016).The residential & commercial real estate sector has seen much momentum across large cities in India with the consumption of IT/ITES spaces by large corporates. The Governments mission to accomplish “Housing for All” will also fuel the growth of REIT. REIT listing will further give a boost to the Indian property market and enhance transparency in real estate transactions. REIT dream will soon become a reality in India. With the recent regulations & subsequent entry by foreign players, the Indian real estate segment

will catch up with other developed real estate markets of the world.

will catch up with other developed real estate markets of the world.

References:-

1. Sebi.com

2. Housing.com

3. Grantthorton.com

4. Pwc.com

5. Knightfrank.com

6. Credai.org