Private Labels: Their growing importance in Retailing

Prof. (Dr.) S. Shyam Prasad

Abstract

Private labels are growing in importance and influence our buying behaviour. They form a part of our buying cart. In India, where the brand consciousness is low, this article proposes to be the exponent of ‘Private Labels’. This will help in understanding what are ‘Private Labels’, and the reasons for their existence and proliferation. This article also brings out a pitfall of over relying on private labels.

Introduction

We are in the era of hypercompetition- a situation in which there is a lot of very strong competition between companies, markets are changing very quickly, so that it is not possible for one company to keep a competitive advantage for a long time.[1] The market, particularly the Indian retail market remains a highly potential with accelerated growth of 15-20 percent expected over the next five years.[2]A T Kearney, a US Based global management consulting firm has ranked India as the fourth most attractive nation for retail investment among 30 flourishing markets. At a growth rate of 15 per cent, the retail market is expected to reach a whooping Rs. 47 lakh crore by 2016-17, according to the ‘Yes Bank – Assocham’ study.

As mentioned above, Indian Retail sector has been growing in the organized segment with many domestic players with vast resources at their disposal stepping in with huge investments and long term plans. Major players such as Bharti, Tata, Reliance and Adani have made huge investments in the Indian Retail market. The growth of disposable income and the young population (more than 30% of the country is below 14 years) are the driving of the organized retail sector. In such a flourishing and productive market, every company is trying to create a niche for itself. In their endavour to sustain their business, the retailers have come out with the idea of ‘Private Labels’

Private Labels

The Private Label Manufacturers Association (PLMA), founded in 1979 in US, states that “Private labels products encompass all merchandise sold under a retailer’s brand. That brand can be the retailer’s own name or a name created exclusively by that retailer. In some cases, a retailer may belong to a wholesale group that owns the brands that are available to only the members of the group.”[3]

Some examples of private label brands available in India are:

Wal-Mart India: Some private labels by Wal-Mart in India are Great Value line of food (flour, dry fruits, spices, cereal, and tea), George Apparel, Equate, Home Trends (home furnishing), Mainstays (plastic containers, kitchen accessories), Kid Connection (toys, clothing), Faded Glory (footwear), Athletic Works (athletic shoes, equipment) and Astitva, a line for Indian ethnic wear.

Aditya Birla Group: Feastersbrand (fruit squash, biscuits, fruit syrup, Instant Fruit Mix Powder, Noodles), 110 Per Cent (toilet cleaners, detergents, soaps), Paradise (Room Air Fresheners), AU79 (Deodorant) and Fresh-O-Dent toothpastes and toothbrushes are some private label brands by Aditya Birla.

Shoppers Stop: Shoppers stop offers Kashish, Haute Curry, Vettorio Fratini and EllizaDonatein private labels in its

products offerings. ‘Life’ T-shirts for men, while ‘Stop’ as ladies western wear.

products offerings. ‘Life’ T-shirts for men, while ‘Stop’ as ladies western wear.

Vishal Megamart: Vishal Megamart’s offers salt and toothbrush under its `Vneed’ brand.

Pantaloon Retail India Limited: Pantaloon Retail India Limited offers “Fresh n Pure, Cleanmate, Tasty Treat, Caremate, Sach brands in food and FMCG; DJ&C, Kinghthood, John Miller brands in men’s apparel. Tasty Treat in food segment and in the baby diapers segment Care Mate are its private labels. In the Electronic Bazaar it offers refrigerators, washing machines, air conditioners, fans, toasters, and kitchen mixies in the brand name KORYO.

Prognosis of Private Labels

The latest market share data on Private labels shows that their popularity continues to spread across India and Europe. Retailer brands now account for at least 30% of all products sold in 15 countries, the greatest number ever, according to Nielsen data compiled for PLMA’s 2014 International Private Label Yearbook[4]. In India the share of Private label in the modern retail is about 7%. In China it is less than 1%.

The growth of retail is both due to and the reason for the changes in the consumer lifestyle and buying pattern. The success of a retailer would lie in his ability to attract, engage and retain the customers. Private labels are one such tool to build competitive advantage through creating cost leadership. In building customer relationship, the Private labels provide a win-win solution. The retailers gain better bargaining power over their suppliers and better margins while the customers get a wider choice of prices. Bergès-Sennou et al [2004] cite a survey by LSA/Fournier1 according to which the main reasons retailers develop private labels are: to increase customer loyalty (16%), to improve their positioning (18%), to improvemargins (25%) and to lower prices (33%).

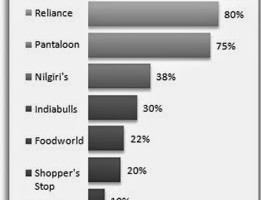

Figure 1 Indian retail industry has seen some ups and downs over the past. However, with steadfast endeavour by the organized sector, the retail industry has now become well entrenched. The private labels or store brands are now common phenomenon in the retail market. Not to be left behind, even the Apollo Pharmacy and Guardian Pharmacy introduced their private labels in 2010 in beauty and personal care products.

Though the growth of private labels is seen across categories, growth in grocery is prominently seen in supermarkets at 15% and hypermarkets accounting for 30% of total value sales.[5] In a report published in 2012 by the Technopak’s Advisors Private Ltd, food and grocery segment is a key driver for private labels accounting for 20-25 percent, and sometimes even 40 percent, of all categories in private labels and margins in private labels in staples like sugar, groceries can range between 15-25%.

The figure 1 clearly shows that the private labels are gaining significance in India and its acceptance is on the rise across the product categories such as apparel, consumer durables, home care and FMCG segments. Some reasons that can be attributed for their growth are

1. High Margin: The advertising and promotional costs are done away with the private labels and so they offer high margins.

2. Customer Loyalty: If the private labels are assuring quality products, the retails ensure a high degree of loyalty. Studies have also shown that private label buyers are more store-loyal and not as easily influenced as brand buyers.

3. Differentiation: The private labels provide the retailers with an opportunity to come out with unique products that cater to the local tastes and preferences. Thus they can differentiate themselves from other stores.

4. Better Bargaining Power: A successful retailer with private labels can leverage his margin and is in a better position to negotiate with his suppliers of branded products.

Conclusion

The private labels have now come to stay. They cannot be wished away. However, the retailers should keep in mind that overdoing anything is bad. Private labels cannot be promoted at the cost of national brands. The private labels can only act as complementary to the national brand. If the private labels are over done, it may affect the store image and will keep away some customers. If done properly, the private labels should be a win-win proposal.

Bibliography

Acharaya, Prachi N. M. (2013). Exploring Antecedents of Private Label Brand Patronage and Its Impact on Store Choice Attributes and Store Patronage.

Bergès-Sennou, F. B. (2004). Economics of Private Labels: A survey of the literature. Journal of Agricultural and Food Industrial Organization, vol. 2 (1) .

Loy, Jens-Peter et al. (2009). Do Private Labels Generate Loyalty? Empirical Evidence for German Frozen Pizza. International Food and Agribusiness Management Review Volume 12, Issue 4, 2009

Malviya, Sagar. (2012). Private labels owned by retailers such as Bharti Retail, Future Group outsell national brands in own stores. Economic Times, Feb 6, 2012.

THE END

[2] http://www.atkearney.com/consumer-products-retail/global-retail-development-index/full-report/-/asset_publisher/oPFrGkbIkz0Q/content/global-retail-development-index/10192

[3]http://www.plmainternational.com/industry-news/private-label-today

[4]http://www.plmainternational.com/industry-news/private-label-today accessed on 16.10.2014

[5]http://www.indiaretailing.com/7/23/25/9469/The-Growth-of-Private-Labels-in-India accessed on 20/10/2014