30 Dec 2023

No matter if you are an independent contractor, an employee, or an entrepreneur, having savings is crucial since it can help you in times of need. Not only that, but you can also invest that extra cash in profitable ventures and even necessities like real estate that will enable you to increase your income. The most crucial step towards achieving financial stability and security is setting aside money from your earnings from work or your wage. But sometimes it seems like there’s no way to save money. The good news is that by utilising some fantastic apps, you may save money in India without going over budget.

Money Club

Money Club is an online committee system that offers excellent savings opportunities. A committee is a kind of community savings circle in which each member agrees to contribute the same amount for a predetermined period of time each month. During the rotation, the entire “pot” of money is given to each committee member once. It is the first social network ever created with the purpose of assisting users in making money, saving money, and supporting one another monetarily. You can take out up to ten times as much money as you have saved, which makes it one of the greatest apps for budgeting. You will receive 15%–20% p.a. if you take out the full amount at the end. The app’s more than 400K registered Indian users have been validated to ensure

You can join a variety of clubs after registering and being screened. The programme offers real-time pooling and bidding, and its user interface is quite easy to grasp. Additionally, you can advance in the journey by joining more clubs and withdrawing multiple times as your track record improves.

Mint

In Mint, you can create bills, schedule when to pay them, monitor your spending, and create budgets. The interface of the app is user-friendly and facilitates seamless browsing. Synchronising a bank account is a good place to start. Following that, you can categorise your spending and expenses and may operate in a keep tabs on your financial activity. The application is password-protected so that you secure environment.

Thriv Fin-Tracker

Your financial goals can be made, tracked, and managed more skilfully with the aid of the money-saving programme Thriving Savings Goal Tracker. It is a single programme that serves as a budget planner, savings planner, cost management, and money tracker. If you want to encourage yourself to track your spending and save money, you need Thriv. By color-coding your progress, keeping track of your saves, and giving you an overview of all of your costs and savings, it gives you a bird’s-eye view of your financial objectives. Additionally, using Google Drive to backup all of the data is easy.

Digit

Digit is a great money-saving app that handles all of your planning and execution while you stay committed to saving. It monitors your earnings and outlays and helps you save money every day. It determines how much you can save and moves any money left over to a Digit account that is protected by the FDIC. Every once in a while, the application conducts research and shares its findings with you. You also have the chance to earn a savings bonus every three months.

Split wise

Split wise is a fantastic choice if you want to split expenses with friends. You can input individual costs and collaborate with others to form expense groups. The amount you owe your friends, or your friends’ amount owing you, will be automatically calculated by the programme. The method of payment is up to you. It maintains basic records and assists in covering growing expenses. You may also always check at the previous distribution of the group’s expenses.

CREDIT

Every time a user pays a credit card bill, this app gives them attractive gifts and incentives. Additionally, if you want to utilise this software, you can add more than one card and forget about the various billing cycles associated with each card. With each bill payment, users of this app can earn 1 point, or Rs. 1, as part of its incentive system. These points can be later redeemed for the items of your choosing. Other features offered by CRED include “buy now, travel later” and CRED Rent Pay. A complimentary credit line of Rs. 5 lakh can be obtained with the aid of these features.

Dhani

In India, Dhani is a highly recognised app for managing finances. This programme can be used for all of your financial requirements. With the aid of this software, one may, for instance, apply for a personal loan or start a Demat account instantaneously. It also makes it possible for you to handle your money. Other recreational elements of this programme include the ability to play games for real money and listen to educational podcasts. The Dhani Rupay card can also be used to make purchases at a variety of national retailers.

Wallet

Wallet is a widely used visual application in India that provides consumers with quick and simple insights. It also offers both free and premium features. Additionally, you can choose to use a two-week free trial to test things out before deciding to pay for the service. Furthermore, by linking your bank accounts, you may centralise all of your accounts and automatically monitor your spending. All transactions are automatically synced, classified, and budgeted for security using this app. You may also monitor your bills and their due dates, keep an eye on your upcoming payments, and predict how they will affect your financial flow.

Money Manager

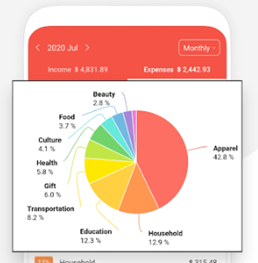

The vibrant and colourful user experience of Money Manager makes managing finances simple and engaging for novices and those using the app for the first time. For bill entries, you can include photos, which comes in useful when you have to present receipts for work. Sub-categories such as income and expenses are included in this user-friendly app. For ease of understanding, it also presents all of these details in the form of a graph or pie chart.

Good budget

Reasonably priced Good budget is specifically made for budgeting and personal financial management. Moreover, it manages finances using an envelope approach. Any data in this case is automatically backed up and secured on the app’s website. With the help of this app’s intelligent payee and category recommendations, you can save a lot of time. Additionally, transferring money between Accounts and Envelopes is simple. Additionally, this programme creates a budget for you so you can monitor your expenses in advance.

Conclusion

Maintaining sound financial standing and preventing wasteful spending are made easier with the help of money tracking. The top money management applications mentioned above can help you find areas where you can cut back on your spending. Using these apps is simple, and keeping track of spending is made hassle-free. Selecting the ideal money management software is advised if it meets your wants and advances your objectives.

These money management applications’ primary goal is to make it easier for users to keep an eye on and manage their spending. They make weekly and monthly budgets for the users and handle their personal finances. People are able to avoid going over their budget and instead stick to it. The majority of money management applications allow users to limit spending in areas where they have overspent by providing a thorough picture of those areas. In addition to helping people manage their spending, some applications offer advice on where to put their funds and assist with investing.

Probable questions:

- What could be the other financial application arenas or options available for students to explore in today’s time?

- How safe is it to manage money when everything is synchronized to an application?

- What are the security issues using applications for money management?

- Where do you see Indian society adopting digitization for money management?