In the era of Rational Expectations Hypothesis holding true with almost every investing community, do firms make the payout policies to achieve their managerial objectives or to please the investors’ ‘bird-in-hand’myopia? Is the Graham and Dodd’s theory of firm value depending more on dividend payout ratio than the retention ratio, is indeed true? Does Miller and Modigliani’s ‘theorem of dividend irrelevance’ as contrasted to John Lintner’s ‘dependent corporate dividend behaviour model’ holds its argument in the current corporate finance practices?

John Lintner is the first to propose a quantitative model of dividend payout policy in the 1950s. He studied 16 manufacturing firms of America to arrive at his proposal. In Lintner’s words – “savings (retained earnings) in a given period generally are largely a by-product of dividend action taken in terms of pretty well established practices and policies”. By this he means that corporate decision-makers do find dividend payout to be a relevant determinant of the value of the firm and such firms tend to distribute earnings to owners in a target payout ratio, predetermined along with a conservative adjustment towards the sustainability of increased earnings of current year as compared to the previous. Lintner found a positive constant, reflecting firms’ preference to increase dividends with the increase in earnings. Since then, the model has been supported as well as contested by researchers across. Many found that initial slope for adjustment in Lintner’s basic model, (which was roughly 0.33) and positive intercepts were no more the same. The slope for adjustment has reduced and constant was moving towards negative. The supporters of applicability of Lintner’s model claim that this was because of investors and corporates preferring non-cash dividends, which when considered in the total payout, do prove Lintner’s argument. These pro and against arguments continue to throw light on understanding corporate dividend behaviour leading to different purposes being met for different stakeholders. Decision-makers are better equipped to support their dividend decisions in their annual reports. Corporate governance is kept intact. Investors are able to find the right valuation of the firm’s stocks. For instance, the dividend growth model uses future dividends to be the determinant of value of equity or the free cash flow model uses the growth rate of firm’s earnings based on the ploughback ratio, which is the residual after dividend payout ratio. Given the increasingly complex ownership structures and increasingly demanding nature of investors, dividend payouts are viewed from varied perspectives. For some, it’s bird-in-hand and for some reduced stake.

Statistical Modelling & Testing

It is in these contexts that we attempt to examine whether Lintner’s proposal works even now and if so, what is driving the target payout ratio. We take the case of Indian firms for the study and bring forth the dimension of dividend decisions of firms operating in the emerging and growing economies with wider fluctuations in their earnings. The objective of this study is to examine the dividend behaviour of Indian firms. By dividend behaviour we mean, the pattern of determining the dividend payout in a given year. In other words, what are the factors that influence the dividend decisions of Indian firms? The study also aims to analyse whether such behaviour is in line with Lintner’s theoretical model of corporate divided behaviour with dependency and relevance.

We tested the below hypothesis, which is partially based on Lintner’s model:

H0: Dividend decisions of Indian firms are significantly independent of lagged dividends

H1: Dividend decisions of Indian firms are not significantly independent of lagged dividends

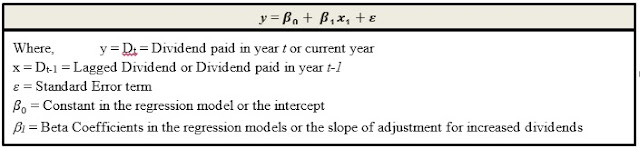

A basic regression model as below was developed for a better understanding:

The sample firms selected using Judgmental Sampling method for the study were LIX 15 and LIX 15 Midcap constituent firms, both aimed to represent the 30 firms that are highly liquid and represent diverse industries. Multiple Regression Analysis is carried out to test the above model, considering lag dividend as the independent variable influencing the current year dividend. The analysis is carried out using SPSS software package. Only the most important outputs of the linear regression analysis are considered for interpretations and presented in the below table:

*statistically not significant

The R value in all the years is signifying strong positive correlation. This indicates that current year dividend declaration and that of the previous year are highly associated to each other. The value of R2is considerably high in all the years except in 2009-10, when it is 0.415, thus signifying Dt-1 can be a good predictor of Dt. ANOVA F-test significance value is below the alpha value of 0.05 (confidence level of 95%) in all the years, suggesting that the model is worth considering as a predictor tool and the relationship between Dtand Dt-1 is not random and there exists a systematic relationship. The a value or the intercept values varying from year to year and except 2009-10 in all other years it is not statistically significant. As the relationship is explained more by the slope of the curve, we may ignore the a value. The b values are positive in all the years signifying the positive relationship between Dtand Dt-1. The t-tests (at 95% confidence level) in all the years’ data suggest that the b values are statistically significant, hence, we reject the null hypothesis – “Dividend decisions of Indian firms are significantly independent of lagged dividends”. It is highly likely that the current year dividend decisions of Indian firms are dependent on the lagged dividends or the level of dividends paid in the previous year. One can use the above suggested model to forecast the dividend payouts of any given Indian firm in the next year. The Durbin-Watson coefficient is spread around the value of 2, even though not very close to 2 indicate that there might be autocorrelation among the error terms and the model may not be completely free from flaws. One may have to use it with caution and might have to better the model with more observations.

Conclusion

This cross-sectional research attempted to examine whether Indian firms follow a stable dividend payout pattern and attempt to maintain the same. Other determinants, like the market condition, firm’s earning, proposed capital expenditure and so on have little or no influence on the decision-makers while deciding on the dividends. The study also restricted its scope to measure the effect of previous year dividend on the current year dividend, and other factors suggested by Lintner and Britain like the earnings, cash earnings, capex and depreciation are not tested for and assumed to be reflected by the error term.