I had attended the conference on 10th Dec 2010 at the Leela Palace, Bangalore on the above subject. The key note address was by Prof. Prakash Apte, Fmr Director, IIM Bangalore followed by two panel discussions. Some of the key points raised by the speakers were:

Prof. Prakash Apte, Frm Director IIM Bangalore

In my opinion he spoke more from the viewpoint of IIM’s. Some of his points were:

· General opinion is that MBA schools are producing Smart Analyst but not

Good Mangers. Some of the core courses on Statistics should be moved to

electives and focus should be more on soft skills

· There can also be specilized programs like Master of Quantitative Finance

· There should be more students with liberal arts backgrounds

· MBA Programs should be taught to students who have already managed.

There needs to be some way to objectively measure other parameters other

that CAT score. One suggestion was to have a quota system which will address

the lack of Diversity in background at IIM’s.

· Need for more emphasis on Business Ethics, Corporate Governance & Social

Responsibility.

Responsibility.

· Need to have more emphasis on involving practioners.

Panel 1

Sudhir Hasija – Karbonn Mobile

· MBA’s while entering should be knowlegeble about the profile of job.

Ravi , Nike

Taked on the ‘Challenges of Implementing a Business Strategy’

· 70% of Strategy implementations fails.

· MBA’s want to do business strategy without experience in implementation. Reason: Business

Strategy work is over compensated & closer to seats of power

Strategy work is over compensated & closer to seats of power

· Strategy

Ø What is Strategy? A waterway to your vision.

Ø Slow & long Journey.

Ø Big & Small obstacles.

Ø Upstream & Downstream impacts

· Why Strategic Implementations fails?

Ø Communication.

Ø Leadership.

· Rules for the students:

Ø Do your time

Ø Execute

Ø Get the big picture.

Somnath Baishya, Hr Dir – Nokia

· Human Capital impacts org. success

· WOW (Ways Of Working) at Nokia

· Should not fall into a success trap since demands keep changing based on the size of the organization

· One size does not fit all

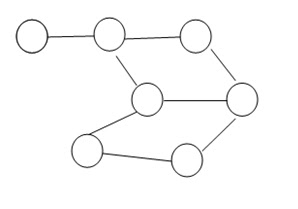

· Org. 3.0: New Realities: Networked clusters of competencies

· Building Organizations through people

· “Company is the campus, Business is the curriculum & Leaders shall teach”

· Marrying case studies with conceptual frame works.

Ø Ability to question?

Ø Ability to understand a global contact?

Rangan Mohan, Hindya Global Solutions

Traditional – Material

} Commodities

Money

Manpower – Mindpower

Mindset

· The shift in business has been from companies to professionals competing with one another.

· Systemitic Thinking is required in MBA’s:

o Analysis —-Ability to breakdown things

o Synthesis— Ability to bring together things.

o 3G’s 3I’s 3P’s 3R’s

Customer Contric Intellect People Relevance

Communication Interpersonal Skills Process Rigor

Change Integrity Passion Research

· Prepare students with Independent Decision Making

· E– Expose S – Simulate P – Practise

· Solve faculty shortage problems through:

o Policy

o Technology

o Campaign – B School to Corporates.

Panel 2

Srinivas, Head Person Edu, India.

Ø MBA’s have a Hallowed image about what to expect from the job

Ø There should be Outcome based learning.

Ø Lot of faculty do not have management experience themselves.

Amitabh Mukherjee, ITC

Students should have:

· Pesistence of purpose.

· Articlate a point of view.

· Balance.

· Endurance to last the race [ Marathon]

Martin Gomez, Thomson Rusters

· MBA’s should be grounded.

· Learning as per Thomson Reuters:

70 % On the Job 20% Networking (Persons) 10% Classroom

· Be in listining mode.

· Balance between theory of practice.

· Understanding of conceptual Knowledge.

· Success is not at the cost of another person.

Mac, 3M

MBA programs should have:

· Orentation Program on corporate ground realities.

· Right mix of students.

· Electives should reflect “Survival of Fittest”

· More live cases.

· Is it possible to built extra-curriculam activities built into the grade system.

· Not enough focus on socialistic values.

· Prepare students for family & other responsibilities

Krishnan, Lindas

· Students have been packaged.

· Make them emotionally intelligent.

Satish, Microsoft

· Career is a long journey.

· From the industry side, having an industry mentor.

· Send students to villages & small places for exposure.

Nitin Garg

Director

ISME