Sudindra V R

Security Exchange Board of India (SEBI), regulator of Indian security market issued a show-caused notice to some of the firms which are into security market broking and advisory services. The notice states the preferential access scandal and strategy building to enhance quick profit. Regulator has further investigated into NSE co-location space, the first case initiated in the year 2015 against OPC securities, its associates GKN securities and Way2Weatlh Brokers Pvt. Ltd. With the help of forensic analysis, regulators found 62 broking firms took undue advantage. This investigation created havoc among the market players and question raised what went wrong. The Security Exchange Board of India’s investigation reveals that the scandal, co-location space and other irregularities appeared because of Algorithm Trading.

What is Algorithm Trading?

Algorithm is an orders that is generated using automated execution without human intervention in the security/stock market trading. Execution of trade will be based on pre-determined criteria with the help of computer programs and software. Algorithm uses step by step instruction through trading actions undertaken by automated system.

How it is different from Human Trade:

Human trade require to be there at the desk all the time during the market trading hours to execute the large number of orders without break. In case of Automated trading the automated computers will be matching orders according to pre-determined strategy.

In the human trade, the minimum speed of punching the orders based on small experiment conducted during 1991 was 0.101 seconds. Whereas the algorithm trade utilizes 100 uptimes with Micro second of 0.000001 seconds.

Algorithm effectively used short lived opportunities in market to make quick profit through high frequency trading which is impossible with human trade.

Human can handle and monitor maximum of 50 instruments in a given set of time and highly impossible to manage 1000’s of trade portfolios, whereas the Algorithm can handle up to 10,000 instruments parallel.

Initially the Algorithm trading required infrastructure set up through network, computing power and skilled resources, over a period of time the cost of trading become very minimum. The cost is depending on the adoptability and quick change to technology and also the future government policy to regulate the security market.

Retail and small time investors can be benefit from Algorithm trading which leads to increasing breadth and depth of market and may possible to remove price inefficiencies. But the retail/small time investors need to build strategies and its impact study analysis may take enormous time and efforts. It also requires the information infrastructure, regular data visualization and monitoring, which may practically difficult.

Algorithm trading is not only faster and preserving machines, it disciplines the way of trading through extensive computation, systematic execution of trades and possibility of back test and risk management.

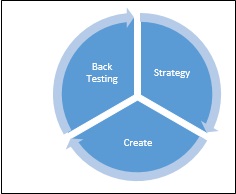

Algorithm creation Cycle:

· The first step in Algorithm trading is Strategy; although Algorithm uses automation, the creation of strategy mainly done by human being using various data/analysis which can be converted into strategy. Most common strategy used by traders include super trend and the strategy depends on market volatility.

· Creatingis the next cycle of Algorithm trading by using the

Programming language like Python, R or any other trading software.

· All the created automated trading may not work with 100% accuracy; the strategy has to be tested through back testing. It involves analysis of past performances, past data and optimization.

· If the back testing gives satisfied result, one can automate trading with the help of sophisticated integrated software.

Prerequisites to Algorithm Trading:

Anyone interested in Algorithm trading require the basic understanding of stock market and financial market, basic data analysis, statistical tools and techniques, advanced stats to test hypothesis, market micro structure, trading portfolio optimization, back testing and programming knowledge like R, Python, Matlab etc.

Essentially it is an integration of knowledge of financial market and technology makes trading efficient and profitable.

References:

Jayshree P. Upadhyay. (2019, 04 9). Retrieved from https://www.livemint.com: https:// www.livemint.com/market/stock-market-news/13-more-firms-on-sebi-radar-as-probe-into-nse-algo-trading-case-widens-1554763296561.html

Sucheta Dalal. (2019, 05 03). Retrieved from https://www.moneylife.in: https:/

/www. money life.in/article/nse-algo-scam-with-draconian-powers-at-its-command-sebi-finally-did-a-desktop-investigation/57060.html

/www. money life.in/article/nse-algo-scam-with-draconian-powers-at-its-command-sebi-finally-did-a-desktop-investigation/57060.html

Corporate Authors, (2018, 07 24). Retrieved from https://www.quantinsti.com: https://www. quantinsti.com/blog/algorithmic-trading-india.

Disclaimer – The views, opinions and content on this blog are solely those of the authors. ISME does not take responsibility of content, which are plagiarised or not quoted.