– Prof. Sakeerthi

Introduction

It was my second last session for the MBA second-year students of my previous organization and it was a class on banking. Amidst discussions on the NPA issues and other governance issues in Indian banks, I put forward a question on BBB. Not sure if the whole batch was unaware of such a term in banking or were reluctant to answer, but to my surprise, none of them even made an attempt to answer my query. I made one more attempt by asking them to come up with anything that comes to their mind on hearing “BBB”. This time a boy stood up and said… “Mam, BBA is Bachelor of Business Administration, but I am not sure if BBB is some new course on business administration like BBM or BBA”. I stood expressionless for a while hearing his answer. A final year PG (Finance) student had given this explanation for my question on our government’s most boasted initiative to address the banking issues of the country. An insight into the various aspects and importance of Bank Board Bureau is not just important for a finance student, but it is also very important in terms of many competitive exams (especially IBPS which carries many questions about BBB) for which a lot of students and working professional appear every year. This article might give some basic idea about BBB to the reader.

Infusion

Bank Board Bureau is an autonomous body of the Government of India, which is set to increase the efficiency of the governance of the public sector banks of the country, make recommendations in the selection of heads of the government-owned banks and financial institutions and to help banks with strategy formulation and capital raising. Prime Minister Narendra Modi in 2016 approved the constitution of BBB as a body of eminent professionals and officials to make recommendations for appointment of whole-time directors as well as non-executive chairmen of PSBs and it started functioning as a full-fledged body of government from April 2016. The “BBB” is a result of the recommendations of the P J Nayak Committee, which was introduced as a part of the Indradhanush Plan of the government in order to give strength to the government’s initiative of reforming the Indian Banking system.

Former Comptroller and Auditor General, Mr. Vinod Rai was the founder chairman of BBB, who served the office for a tenure of two years which ended in March 2018 and Mr, Bhanu Pratap Sharma took over the reins from the former thereafter for the Mumbai-based bureau.

They were also given the task of engaging with the board of directors of all the public- sector banks to formulate appropriate strategies for their growth and development.

Besides, it was also asked to frame a strategy discussion on consolidation based on the requirement. The government wanted to encourage bank boards to restructure their business strategy and also suggest the way forward for their consolidation and merger with other banks.

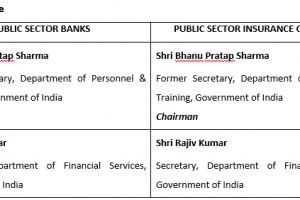

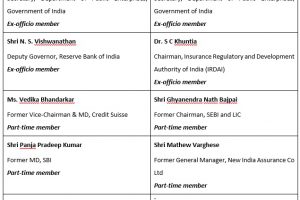

Composition:

The Bank Board Bureau comprises of Chairman, three ex-officio members (from the government) and three expert members, two of whom are from the private sector.

Functions of BBB:

A bulk of the functions of BBB is advisory in nature which involves the following:

· Make recommendations for the appointment of full-time directors as well as the non-executive chairman of public sector banks

· Give advisory services to public sector banks for developing various strategies for fundraising through innovative financial methods and instruments and to deal with the issues of stressed assets

· Guiding the public sector banks on decisions regarding mergers and acquisitions and other such governance issues and to address the bad loan issues among others.

Major and the most recent recommendations made by BBB

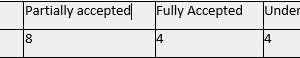

The Bureau has been making various recommendations to the Government in line with its mandate. The Bureau recommendations can be broadly grouped into 16 heads and the status of these recommendations is as under:

The major recommendations that were accepted by the Government in August-September 2019 related to the roles and responsibilities of the Non-Official Directors, the number of executive directors in PSB boards, the performance appraisal of top executives, appointment of chief risk officer, etc. The Bureau is continuously evaluating its recommendations in light of the dynamic changes to the capital and business structure of PSBs and feedback from the stakeholders. The Bureau along with the Reserve Bank of India continues to engage with the Government on the pending recommendations.

The other major recommendations made by the board are:

· In November 2019, the board has recommended the names of Sanjiv Chadha, LV Prabhakar and Atanu Kumar Das for the posts of Managing Director and Chief Executive Officer (CEO) of Bank of Baroda, Canara Bank and Bank of India respectively.

· In August 2018, the board had appointed two firms, EGON ZEHNDER INTERNATIONAL PVT. LTD. And HAY CONSULTANTS PVT. LTD. To assist in developing strategies for top bank management. Eg

on Zehnder was appointed as Knowledge Partner to design, implement and institutionalize a flagship leadership development strategy for state-run banks I India, whereas, Hay Consultants was appointed to assess leadership competencies and potential capabilities of people appearing for the post of whole-time directors in state-run banks. Incidentally, these appointment recommendations came at a time, when the majority of the state-run banks were struggling to appoint quality people in top management.

on Zehnder was appointed as Knowledge Partner to design, implement and institutionalize a flagship leadership development strategy for state-run banks I India, whereas, Hay Consultants was appointed to assess leadership competencies and potential capabilities of people appearing for the post of whole-time directors in state-run banks. Incidentally, these appointment recommendations came at a time, when the majority of the state-run banks were struggling to appoint quality people in top management.

· Again in June 2018, the board recommended the names of at least a dozen people to don the roles of MDs and CEOs of prominent state-owned banks. For instance, it suggested Ansula Kant, the CFO of SBI to become the MD of the Bank after the position fell vacant when the incumbent MD, Mr. B. Sriram, moved to head IDBI Bank.

Conclusion:

The formation of the Bank Board Bureau has been one of the biggest milestones in the history of Indian Banking. It was set up with a huge responsibility of revamping the debt-ridden PSBs and providing recommendations for the appointment of chiefs of such PSBs. Recently there has been a lot of controversies brewing up regarding the role played by BBB as many of the recommendations of this committee were not considered with due importance. The body needs to be given more freedom and power if it has to deliver the results it is expected to yield. Also the presence of the people having links with ICICI bank in the helm of BBB is drawing a lot of wrong attention. Shri. P Pradeep Kumar, one of the part-time members of BBB was on the advisory board of Avista Advisory, owned by the brother in law of Chanda Kochhar, the ousted head of the ICICI Bank after news of her alleged involvement in the ICICI-Videocon scam. When a body is formed with a lot of hipe to address critical issue of revamping of PSBs, there comes a question of what kind of members should be on its governing and decision making body. When the credibility of the decision makers itself is under limelight, how can one ensure the body to function smoothly. The presence of people like Pradip Kumar on the advisory board will not only send mixed signals to the investigating agencies, but will also call into questions on the nature and effectiveness of the probe that is going on in ICICI case. The BBB faced backlash in the initial days of its formation with the exit of high-profile people from its board. It started with the exit of Roopa Kudva, who chose to resign from the top post in BBB rather than resigning from the MD post of Omidyar Network India Advisors, which was also headed by her while she was appointed as a member of the governing body of BBB. Later followed the stepping down of Shri. Vinod Rai, amidst expectation of him extending his tenure to serve BBB. All these developments have not only posted a question mark on the effectiveness of BBB, but is also posing serious questions on the role and the autonomy of the institution. Although, the BBB was incorporated by giving a lot of vested powers in terms of appointments for top-positions and strategy formulation in PSBs, now lot of questions are coming out on its limited role and about the big names leaving the body without giving a justifiable reason for quitting. According to me, BBB is a great initiative which is not doing well owing to its wrong implementation. Being an autonomous body, it should have clear cut vested powers and should work as a completely independent body like the Supreme Court of India or RBI, rather than getting reduced to a supporting body of RBI, with not much say on the major decisions made regarding PSBs. Also, the selection of the governing members should be done with utmost care, giving due importance to the credentials of the person and after doing a thorough background check. It should not become a case where the judge hearing the case is himself a culprit in it. This takes away the faith of the people in the institution and it will not be able to serve the purpose for which it was formed. While demonetization and GST can be considered as two great initiatives of Modi government which went wrong due to its untimely and unplanned implementation, BBB remains to be yet another great initiative which is not serving its purpose due to lack of clarity on its role and wrong people on its helm.

Sources:

Disclaimer: The views, opinions, and content on this blog are solely those of the authors. ISME does not take responsibility for the content which are plagiarized or not quoted