PERFORMANCE

OF SELECTED GLOBAL STOCK INDICES FOR THE MONTH OF SEPTEMBER 2016

OF SELECTED GLOBAL STOCK INDICES FOR THE MONTH OF SEPTEMBER 2016

Sudindra VR

1.

INTRODUCTION

INTRODUCTION

Last consecutive trading days’ global

indices have shown negative trend, due to volatility in US and latest

development of US tepid recovery news. Stock markets across the globe are

trading at record high, NASDAQ and NYSE is up by 232% and 126% since the market

bottomed in 2008-2009 crisis and with slow in recovery the record high trading

is not sustainable. Several noted economists and distinguished investors are

warning of stock market crash in 2016. The report of Harvard business school

concludes the inability of US government to bolster US competitiveness

worldwide. Many experts in India expecting the market to be volatile in the

month of September 2016. The latest development of US tepid recovery news will impact

the entire global stock market. The present study analysed the market

performance through return and volatility of major global indices of G20

countries whether the expert’s opinion will hold good.

indices have shown negative trend, due to volatility in US and latest

development of US tepid recovery news. Stock markets across the globe are

trading at record high, NASDAQ and NYSE is up by 232% and 126% since the market

bottomed in 2008-2009 crisis and with slow in recovery the record high trading

is not sustainable. Several noted economists and distinguished investors are

warning of stock market crash in 2016. The report of Harvard business school

concludes the inability of US government to bolster US competitiveness

worldwide. Many experts in India expecting the market to be volatile in the

month of September 2016. The latest development of US tepid recovery news will impact

the entire global stock market. The present study analysed the market

performance through return and volatility of major global indices of G20

countries whether the expert’s opinion will hold good.

2.

OBJECTIVES:

OBJECTIVES:

The objective of the study is to find

out the impact of US tepid growth and decision regarding increasing policy

rates to boost economy and the impact on it’s the global stock indices.

out the impact of US tepid growth and decision regarding increasing policy

rates to boost economy and the impact on it’s the global stock indices.

3.

METHODOLOGY:

METHODOLOGY:

The study is empirical in nature; the

study consists of analysing 19 major global stock exchanges of G20 nations. For

the purpose of study primary data has been used. Primary data includes 19

global stock exchanges closing prices from 1st September 2016 to 14th

September 2016 sourced from www.quandle.com. Average return and

standard deviation has been calculated to analyse the performance of global

indices.

study consists of analysing 19 major global stock exchanges of G20 nations. For

the purpose of study primary data has been used. Primary data includes 19

global stock exchanges closing prices from 1st September 2016 to 14th

September 2016 sourced from www.quandle.com. Average return and

standard deviation has been calculated to analyse the performance of global

indices.

4.

DATA ANALYSIS:

DATA ANALYSIS:

Table

4.1 Table showing average return and standard deviation of 19 selected major

G20 countries stock exchanges for the period of 1st September 2016

to 14th September 2016

4.1 Table showing average return and standard deviation of 19 selected major

G20 countries stock exchanges for the period of 1st September 2016

to 14th September 2016

INDEX | AVERAGE RETURN | STANDARD DEVIATION |

NIFTY | -0.06 | 0.90 |

NIKKEI JAPAN | -0.21 | 0.71 |

S&P 500 US | -0.24 | 1.14 |

NASDAQ US | -0.12 | 1.19 |

SHANGAI COMPOSITE CHINA | -0.22 | 0.73 |

HANGSENG INDEXCHINA | 0.00 | 1.44 |

DAX GERMANY | -0.17 | 0.84 |

CAC FRANCE | -0.18 | 1.09 |

BOVESPA BRAZIL | -0.29 | 1.97 |

RTSI INDEX RUSSIA | 0.30 | 1.49 |

S&P TSX COMPOSITE INDEX (CANADA) | -0.25 | 0.90 |

ALL ORDINANCE INDEX AUSTRALIA | -0.38 | 0.92 |

IBEX 35 SPAIN | -0.08 | 1.25 |

IPC INDEX (MEXICO) | -0.43 | 0.85 |

KOSPI COMPOSITE INDEX (SOUTH KOREA | -0.19 | 1.01 |

JKSE: JAKARTA COMPOSITE INDEX (INDONESIA) | -0.40 | 0.80 |

RUSSEL 1000 US | -0.24 | 1.16 |

SENSEX INDIA | -0.02 | 0.86 |

MERVAL INDEX (ARGENTINA) | -0.15 | 1.83 |

Sources:

Authors calculation

Authors calculation

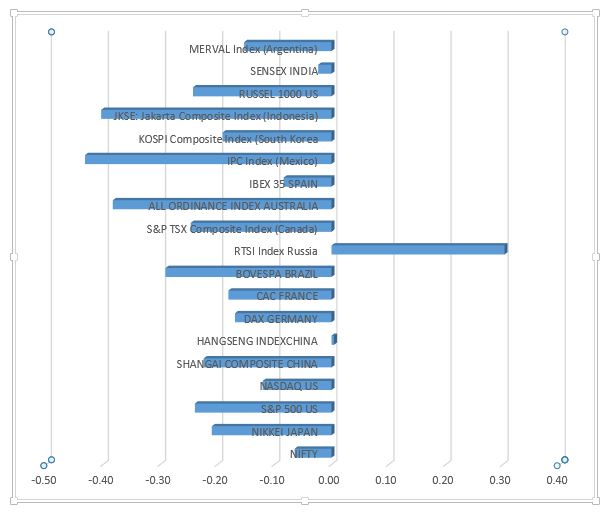

Graph

4.1 Graph showing average return of 19 selected major G20 countries stock

exchanges for the period of 1st September 2016 to 14th

September 2016

4.1 Graph showing average return of 19 selected major G20 countries stock

exchanges for the period of 1st September 2016 to 14th

September 2016

Sources:

Authors calculation

Authors calculation

Inference:

based on above graph it can observe that major

stock exchanges in the month of September 2016 average declined by 0.18% in last

14 days. Brazil, Indonesia, Australia and Mexican indices reduce more than 0.3%,

except Russian market which increased by 0.3%.

based on above graph it can observe that major

stock exchanges in the month of September 2016 average declined by 0.18% in last

14 days. Brazil, Indonesia, Australia and Mexican indices reduce more than 0.3%,

except Russian market which increased by 0.3%.

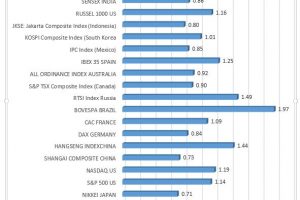

Graph

4.2 Graph showing standard deviation of 19 selected major G20 countries stock

exchanges for the period of 1st September 2016 to 14th

September 2016

4.2 Graph showing standard deviation of 19 selected major G20 countries stock

exchanges for the period of 1st September 2016 to 14th

September 2016

Sources:

Authors calculation

Authors calculation

Inference: based on above graph it can observe that the global market

is highly volatile with average standard deviation of 1.1%. Argentina, Russia

and Brazil markets have shown significantly high volatile among 19 indices and

all the stock exchanges shows above 0.7 standard deviation in last 14 days of September

month.

is highly volatile with average standard deviation of 1.1%. Argentina, Russia

and Brazil markets have shown significantly high volatile among 19 indices and

all the stock exchanges shows above 0.7 standard deviation in last 14 days of September

month.

5.

CONCLUSION:

CONCLUSION:

Several noted economists,

distinguished international investors and Indian market experts are warning on

global stock market in September 2016 which may show negative trend. Harvard

business school report concludes the inability of US government to boost

economy impacting on global stock market indices with low average return and

high volatility. Is this volatility and negative

trend is going to continue for remaining days of September?

distinguished international investors and Indian market experts are warning on

global stock market in September 2016 which may show negative trend. Harvard

business school report concludes the inability of US government to boost

economy impacting on global stock market indices with low average return and

high volatility. Is this volatility and negative

trend is going to continue for remaining days of September?

6. BIBLIOGRAPHY:

Ø Warren Buffett Predicting Upcoming Stock

Market Crash? By John Whitefoot, BA Published : September 13, 2016, http://www.profitconfidential.com

Market Crash? By John Whitefoot, BA Published : September 13, 2016, http://www.profitconfidential.com

Ø 80% Stock Market Crash To Strike in 2016, Economist

Warns, BY JL YASTINE, September 9, 2016, http://thesovereigninvestor.com

Warns, BY JL YASTINE, September 9, 2016, http://thesovereigninvestor.com

Ø Report: US government inaction is hampering economic

growth,

By Josh Boak | AP September 15 at 12:17 AM, www.washingtonpost.com

growth,

By Josh Boak | AP September 15 at 12:17 AM, www.washingtonpost.com